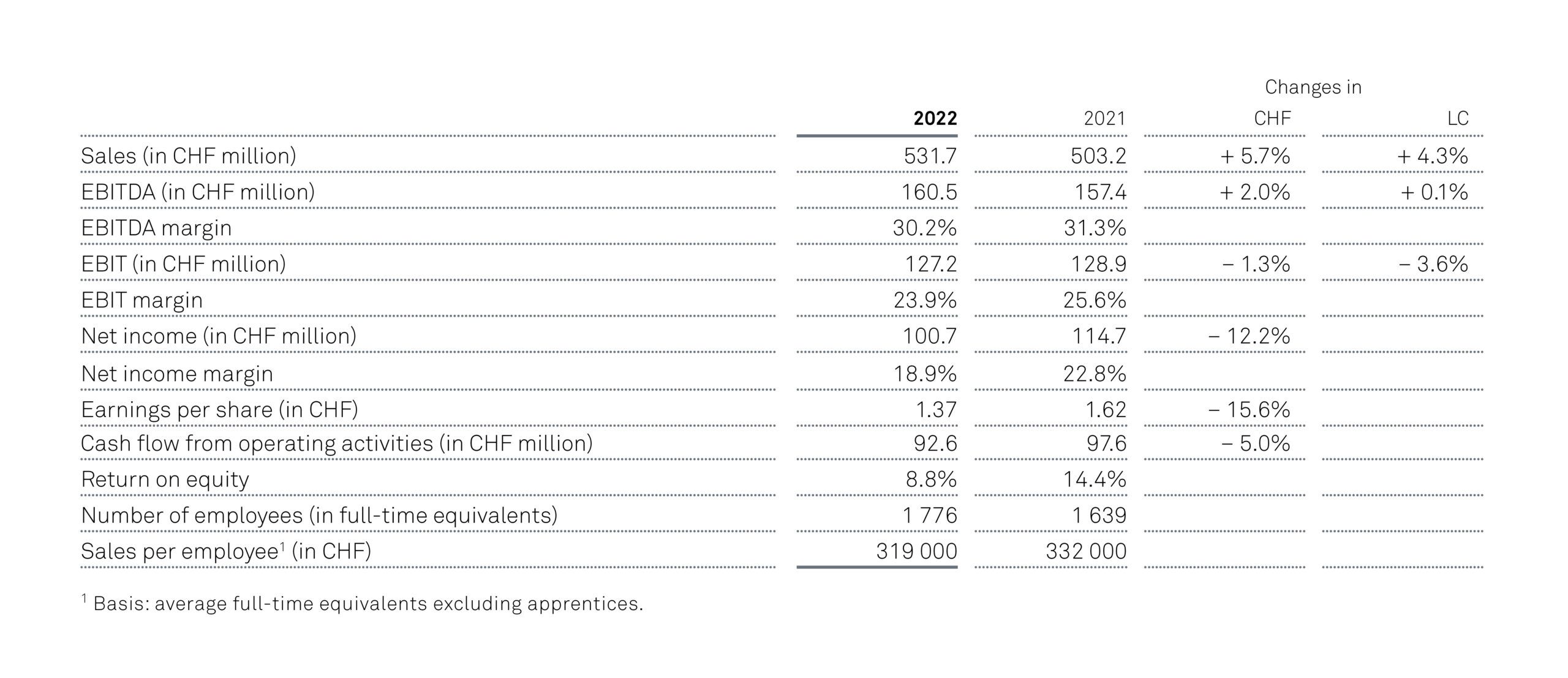

- Group sales rise to 531.7 million by + 5.7% against previous year.

- EBITDA at CHF 160.5 million (+2.0%) with a margin of 30.2%.

- Operating income EBIT at CHF 127.2 million (-1.3%) with a margin of 23.9%.

- Total investments of CHF 142.6 million and creation of 141 new positions.

- Board of Directors proposes an increase of the dividend by CHF 0.05 to CHF 0.75 per share.

Outlook

- Bachem expects sales growth in 2023 to be significantly higher than in the previous year.

- The EBITDA margin is expected to remain stable at around 30% in 2023 compared to the previous year.

- Bachem is pursuing an extensive investment program across all sites and product categories to expand capacities. The commissioning of the new large-scale peptide and oligonucleotide production plant in Bubendorf is planned for 2024. By the end of the decade, a further production site is to be built at the new site in Eiken, Switzerland (Canton of Aargau).

Group results

The Bachem Group (SIX: BANB) increased sales in Swiss francs by 5.7% to CHF 531.7 million in 2022. In local currencies, sales increased by 4.3%. All product categories contributed to the sales growth. As expected, sales in the second half of the year increased by 12.4% compared to the second half of last year, from CHF 264.1 million to CHF 296.9 million.

Operating income before depreciation and amortization (EBITDA) increased by 2.0% to CHF 160.5 million (local currencies: +0.1%). The EBITDA margin of 30.2% (2021: 31.3%) margin is thus within the medium-term target range of over 30%.

Operating income (EBIT) was strongly impacted by increased depreciation and amortization due to the commissioning of investments and decreased by 1.3% to CHF 127.2 million (local currencies: -3.6%). The EBIT margin is 23.9% (2021: 25.6%).

Net income is CHF 100.7 million (-12.2%) with a margin of 18.9% (2021: 22.8%) and is strongly influenced by a negative financial result of CHF 15.2 million (2021: positive result of CHF 2.5 million). The two main factors are a net loss from securities of CHF 13.2 million (2021: net gain of CHF 1.2 million) and a foreign exchange result of CHF -1.3 million (2021: CHF +2.1 million).

Sales by product category and regions

Sales increased in all product categories. Bachem achieved sales of CHF 298.8 million (2021: CHF 285.3 million, +4.7%) with in the category Commercial API, thus reversing the still declining sales trend at the half-year point into the positive. In the CMC Development category, sales increased to CHF 185.8 million (2021: CHF 173.1 million, +7.4%) based on a growing project pipeline with peptide- and oligonucleotide-based compounds. The Research & Specialties category contributed CHF 47.1 million (2021: CHF 44.8 million, +5.2%) to total sales.

Broken down by sales region, the Europe/Asia region generated CHF 316.4 million. (2021: CHF 270.4 million, +17.0%). The North America region accounted for CHF 215.3 million in sales (2021: CHF 232.8 million, -7.5%).

Dynamic market and long-term contracts

The demand for synthetically (i.e., chemically) produced peptides continues to grow strongly. In 2022, Bachem was able to announce supply agreements on peptides for the period 2023-29 with a sales potential of at least CHF 1.2 billion.

Also in 2022, Bachem signed a strategic collaboration with the pharmaceutical company Eli Lilly and Company to develop and manufacture medical agents based on chemically produced oligonucleotides. The cooperation with Eli Lilly and Company provides an annually increasing sales potential and could reach approximately CHF 100 million annually within seven years.

Investment program

Bachem is pursuing an investment program to expand capacity at all sites. CHF 142.6 million has been invested in 2022. The Company is currently building a modern facility to produce high volumes of peptides and oligonucleotides at the Bubendorf site (Building “K” – TIDES FABrication Plant) with the potential to double production capacity at the site. The plant is scheduled to open in 2024. On October 5, 2022, Bachem announced to gradually acquire 155’000 m2 of land in Eiken (Canton of Aargau) for the construction of new production facilities for peptides and oligonucleotides. Bachem is also investing in expanding capacity in its global production network at the sites in Vionnaz (Switzerland), Torrance (USA), Vista (USA) and St. Helens (UK).

Sustainability

The rating agency EcoVadis has awarded Bachem’s performance in the area of sustainability “Platinum” for the first time. This puts Bachem among the top two percent of companies evaluated by EcoVadis and among the top 1 percent within the industry.

Dividend

The Board of Directors will propose to the Annual General Meeting in April 2023 to increase the dividend by CHF 0.05 to CHF 0.75 per share.

Download the Annual Report 2022

The complete Annual Report 2022 can be viewed and downloaded

Press release

in English

in German

About Bachem

Bachem is a leading, innovation-driven company specializing in the development and manufacture of peptides and oligonucleotides.

With over 50 years of experience and expertise Bachem provides products for research, clinical development and commercial application to pharmaceutical and biotechnology companies worldwide and offers a comprehensive range of services.

Bachem operates internationally with headquarters in Switzerland and locations in Europe, the US and Asia. The company is listed on the SIX Swiss Exchange.

For more information:

Bachem Holding AG Dr. Daniel Grotzky Head Group Communications Media: media[at]bachem.com Investors: ir[at]bachem.com