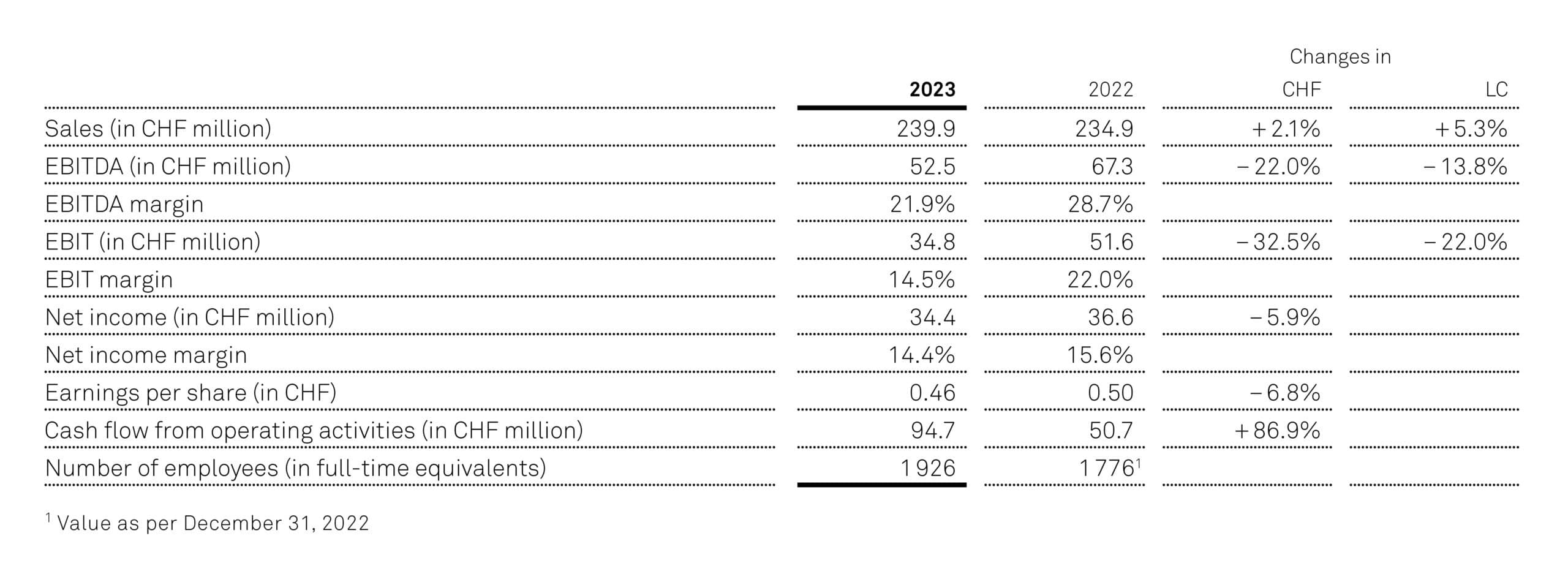

• Group sales amount to CHF 239.9 million (+2.1% compared to the same period of the previous year, +5.3% in local currencies).

• EBITDA at CHF 52.5 million (-22.0% compared to prior-year period) with a margin of 21.9%.

• Headcount increases to 1 926 full-time equivalents worldwide (+150 since December 31, 2022).

Outlook

• For the full year 2023, Bachem expects Group sales to grow in the high single-digit percentage range and an EBITDA margin around 30%.

• The building “K” in Bubendorf will significantly expand Bachem’s production capacity from the start of operations in the course of 2024 and will be further expanded by 2026.

• By 2026, the company aims for annual sales of more than one billion Swiss francs and an EBITDA margin of over 30%.

2023 is mainly characterized by managing a high order volume on existing equipment, while at the same time working on the next capacity expansion and strengthening our team. In the second half of the year, we expect a significant improvement in sales and earnings compared to the first half thanks to a good order book and operational measures.

Group Results

The Bachem Group (SIX: BANB) achieved sales in Swiss francs of CHF 239.9 million in the first half of 2023 (+2.1% compared to the same period of the previous year). In local currencies, sales increased by 5.3%. Bachem started the year with a strong order book, which is being processed on existing equipment.

Operating income before depreciation and amortization (EBITDA) amounted to CHF 52.2 million (-22.0% compared to the same period of the previous year), and operating income (EBIT) was CHF 34.8 million (-32.5% compared to the same period of the previous year). As a result, the EBITDA margin was 21.9% (first half of 2022: 28.7%) and the EBIT margin was 14.5% (first half of 2022: 22.0%). Net profit was CHF 34.4 million (-5.9% compared to the same period of the previous year) with a margin of 14.4% (first half of 2022: 15.6%).

The income statement shows one-off costs of CHF 1.5 million in the first half of 2023. This is due to efficiency measures at Bachem’s US sites, in which the organizational structure and headcount were adjusted to the changed project portfolio. Adjusted for these one-time costs, EBITDA is CHF 54.0 million and the EBITDA margin is 22.5%.

Staff recruitment for the expansion of the Bubendorf site was very successful in the first half of the year. As a result, the headcount rose by 15.8% compared with the first half of 2022 to now 1 926 full-time positions. Some of the new employees are still undergoing onboarding and training processes until the first qualification work begins in the “K” building. This situation has a temporary negative impact on the margin.

Sales by product categories and regions

The Commercial API category achieved sales of CHF 146.9 million (first half of 2022: CHF 131.0 million, +12.2%), driven by patented peptide API and generics sales that more than offset expected lower oligonucleotide commercial sales. In the clinical drug development category (CMC Development), sales amounted to CHF 76.1 million (first half of 2022: CHF 79.3 million, -4.1%). In the comparative period, one-off services for a major customer project had led to a high comparative base, which should balance out over the year as a whole. The research chemicals and specialties business (Research & Specialties) was CHF 16.9 million (first half 2022: CHF 24.6 million, -31.6%). Non-medical projects with small peptide volumes in this category were not prioritized in the first half of the year due to limited production capacities.

Broken down by sales region, CHF 145.3 million were generated in the Europe/Asia region (first half of 2022: CHF 142.3 million, +2.2%). The North America region accounted for CHF 94.6 million in sales (first half of 2022: CHF 92.6 million, +2.1%).

Peptides update

In the first half of 2023, Bachem was able to announce a long-term cooperation agreement for the development and manufacture of peptides. The contract includes a total order volume of more than CHF 500 million for the period 2027-2031, with significant upside potential and is contingent on the completion of a joint development project. The contract diversifies the order backlog for Building “K” in Bubendorf, Bachem’s largest production facility when completed. In addition, demand for services and products for peptides as a medicinal active ingredient remains high.

Oligonucleotides update

In the oligonucleotides business, Bachem anticipates a further reduction in commercial supply volumes. Bachem is working on a number of development projects in all phases of pharmaceutical development and the utilization of the current manufacturing capacities is good. Nevertheless, these development projects cannot compensate for the reduced commercial delivery volumes, so that the targeted sales volume of CHF 100 million cannot be achieved in the short term. In the field of oligonucleotides, Bachem has recently developed technological innovations, such as the production of active ingredients in a patented “stirred bed” process.

Investment program

In the first half of 2023, CHF 114.6 million was invested across all sites. The increase of CHF 76.0 million compared to the prior-year period reflects high customer expectations for a rapid expansion of production capacity. Bachem has started construction of the world’s most advanced peptide and oligonucleotide production plant in 2021. The plant is scheduled to come on stream in 2024. The plant will be further expanded by 2026. A further Bachem production site is planned in Sisslerfeld in Eiken, Switzerland, and a second tranche of land was acquired for this purpose in the first half of 2023. Furthermore, Bachem continues to invest in the infrastructure of the entire site network. Bachem estimates the cost of expanding the Bubendorf and Sisslerfeld sites at over CHF 1 billion by the end of the decade.

Sustainability

Bachem has set long-term sustainability targets for the entire Group in the areas of occupational health and safety, diversity and equal opportunities, as well as energy consumption and greenhouse gas emissions. Bachem’s visibility of greenhouse gas emissions is thereby gradually being extended to include third-party consumption (so-called “Scope 3” emissions). Bachem has also been a member of the UN Global Compact since 2022 and submitted its first Communication of Progress in the first half of 2023.

Bachem Half-Year Report 2023 Press Release

in English

in German

The half-year report 2023, including the slides for the analyst- and media conference can be downloaded in the reports and presentations section of our homepage.

Financial Calendar

March 7, 2024 Publication of the Annual Report 2023; Media- and Analyst Conference

April 24, 2024 Annual General Meeting

July 25, 2024 Publication Half Year Report 2024

Upcoming Financial Events

Would you like to get to know more about Bachem’s upcoming financial events?

Click here >>

Investors & Media

Are you interested in more financial information about Bachem?

Click here >>

About Bachem

Bachem is a leading, innovation-driven company specializing in the development and manufacture of peptides and oligonucleotides.

With over 50 years of experience and expertise Bachem provides products for research, clinical development and commercial application to pharmaceutical and biotechnology companies worldwide and offers a comprehensive range of services.

Bachem operates internationally with headquarters in Switzerland and locations in Europe, the US and Asia. The company is listed on the SIX Swiss Exchange.

For more information:

Bachem Holding AG

Dr. Daniel Grotzky

Head Group Communications

Media: media[at]bachem.com

Investors: ir[at]bachem.com

This publication may contain specific forward-looking statements, e.g. statements including terms like “believe”, “assume”, “expect”, “forecast”, “project”, “may”, “could”, “might”, “will” or similar expressions. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may result in a substantial divergence between the actual results, financial situation, development or performance of Bachem Holding AG and those explicitly or implicitly presumed in these statements. Against the background of these uncertainties, readers should not rely on forward-looking statements. Bachem Holding AG assumes no responsibility to up-date forward-looking statements or to adapt them to future events or developments.